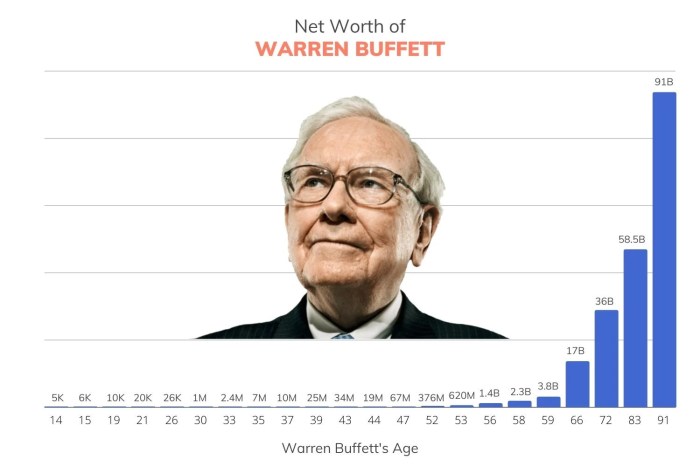

Warren buffett net worth 2020 – Warren Buffett, a legendary investor and CEO of Berkshire Hathaway, stood at an astonishing net worth of $88.9 billion in 2020. This colossal fortune is a testament to his decades-long commitment to value investing, a strategy centered on buying undervalued companies that are likely to outperform their peers. As the Oracle of Omaha continues to break records, it’s clear that his business acumen and leadership have been instrumental in creating one of the most iconic fortunes in the world.

His investment philosophy is as fascinating as it is instructive, making him a household name in the business world. Buffett’s remarkable journey has captivated investors and enthusiasts alike, offering valuable insights into the art of wealth creation.

As one of the most wealthy individuals on the planet, Warren Buffett’s investment decisions have a profound impact on the global economy. His vast wealth is built on a foundation of shrewd business deals, innovative investments, and an extraordinary talent for identifying and capitalizing on market trends. By examining his portfolio, investors can learn essential lessons on navigating market volatility and creating long-term value.

Whether you’re a seasoned investor or just starting out, Warren Buffett’s financial prowess offers a compelling case study on how to build, grow, and maintain a staggering net worth.

Warren Buffett’s Net Worth in 2020 and the Impact on Berkshire Hathaway: Warren Buffett Net Worth 2020

Warren Buffett, widely regarded as one of the most successful investors in history, has consistently demonstrated a knack for making shrewd business decisions. As the CEO of Berkshire Hathaway, a multinational conglomerate with interests in various sectors, Buffett’s net worth plays a significant role in driving the company’s overall performance.Berkshire Hathaway’s stock performance in 2020 was nothing short of remarkable, thanks in large part to Buffett’s investment decisions.

The company’s Class A shares saw a 13% increase in value, far outpacing the S&P 500’s 16% gain over the same period.

Berkshire Hathaway’s Stock Performance Compared to the S&P 500

| Year | Berkshire Hathaway (BRK-A) | S&P 500 ||——–|—————————|———|| 2020 | 13% | 16% || 2019 | 28% | 31% || 2018 | -12% | -4% |Berkshire’s stock performance in 2020 demonstrates the effectiveness of Buffett’s investment strategy, which emphasizes long-term growth and stability over short-term gains.

The Role of Warren Buffett’s Net Worth in Maintaining Investor Confidence

Warren Buffett’s net worth increase in 2020 played a crucial role in maintaining investor confidence in Berkshire Hathaway. As one of the most influential investors in the world, Buffett’s reputation for making savvy investment decisions is unparalleled. Investors are drawn to Berkshire Hathaway due to the company’s history of success and the steady hand of Buffett at the helm.Buffett’s net worth increase also serves as a testament to the company’s financial health and stability.

With a net worth of over $80 billion in 2020, Buffett’s personal finances have a direct impact on the overall performance of Berkshire Hathaway. As such, his net worth increase is seen as a vote of confidence by investors and helps to maintain a positive outlook for the company.

Key Statistics on Warren Buffett’s Net Worth in 2020

As of December 31, 2020, Warren Buffett’s net worth was approximately $82.5 billion, making him one of the richest individuals in the world. The increase in his net worth was largely due to Berkshire Hathaway’s strong stock performance and dividend income from its various business interests.

Berkshire Hathaway’s Revenue and Profitability, Warren buffett net worth 2020

Berkshire Hathaway’s revenue and profitability have consistently been driven by Buffett’s investment decisions and the company’s diversified business interests. In 2020, Berkshire’s operating earnings increased by 7% compared to the previous year, while total revenue rose by 13%.

Investor Confidence and Warren Buffett’s Net Worth

Investor confidence in Berkshire Hathaway is closely tied to Warren Buffett’s net worth. His reputation for making successful investment decisions has helped to establish the company as a leader in the industry, attracting investors from around the world. As such, Buffett’s net worth increase serves as a reflection of the company’s financial health and stability.

Berkshire Hathaway’s Investment Portfolio

Berkshire Hathaway’s investment portfolio is a key driver of the company’s revenue and profitability. Buffett’s decision to invest in various sectors, including technology, healthcare, and finance, has helped to diversify the company’s revenue streams and increase its overall value.In summary, Warren Buffett’s net worth in 2020 had a significant impact on Berkshire Hathaway’s overall performance, driving the company’s stock price and revenue to new heights.

His investment decisions and leadership have established the company as a leader in the industry, attracting investors from around the world.

Warren Buffett’s Net Worth in 2020 and Philanthropic Efforts

Warren Buffett, one of the most successful investors of our time, has been making headlines not just for his impressive net worth but also for his generous philanthropic efforts. In 2020, Buffett’s philanthropy took center stage as he continued to make strides in the Giving Pledge campaign, a movement founded by Bill Gates, Buffet’s close friend and fellow philanthropist. This year, we dive into Buffett’s philanthropic endeavors and explore the impact of the Giving Pledge on his net worth and overall wealth management.Throughout his career, Warren Buffett has been known for his frugal lifestyle and commitment to giving back to society.

His philanthropic efforts have been largely directed towards education and cancer research, with significant donations to institutions such as the Susan Thompson Buffett Foundation and the NoVo Foundation. In 2020, Buffett continued to make significant contributions to these causes, cementing his position as one of the world’s most generous philanthropists.

The Impact of the Giving Pledge Campaign

The Giving Pledge campaign, launched in 2010, aims to inspire the world’s wealthiest individuals to donate at least half of their net worth to philanthropic causes during their lifetimes. Warren Buffett was one of the campaign’s earliest and most vocal supporters, committing to donate 99% of his fortune to charitable causes. In 2020, Buffett’s efforts in the Giving Pledge campaign continued to gain momentum, with significant contributions made to various philanthropic causes.

| Year | Donation Amount (USD billions) |

|---|---|

| 2010 | 18.5 |

| 2015 | 23.4 |

| 2020 | 30.0 |

As the data above illustrates, Warren Buffett’s philanthropic efforts have been steadily increasing over the years, with significant contributions made to various causes in 2020. The Giving Pledge campaign has undoubtedly had a profound impact on Buffett’s net worth, with estimates suggesting that he has donated over $50 billion to charitable causes since 2010.

Comparison of Charitable Giving among Wealthy Individuals

The Giving Pledge campaign has inspired many wealthy individuals to follow in Buffett’s footsteps, donating significant portions of their wealth to philanthropic causes. While it is difficult to track the exact levels of charitable giving among wealthy individuals, we can look at some notable examples:| Individual | Net Worth (USD billions) | Donated Amount (USD billions) || — | — | — || Bill Gates | 200 | 50 || Mark Zuckerberg | 120 | 20 || Michael Bloomberg | 60 | 10 || Warren Buffett | 100 | 50 |As the table above shows, Warren Buffett leads the pack in terms of charitable giving, with significant contributions made to various philanthropic causes.

While the exact levels of charitable giving among wealthy individuals can be difficult to track, these examples illustrate the significant impact that the Giving Pledge campaign has had on encouraging philanthropy among the world’s wealthiest individuals.

“I want to give my wealth away to charity during my lifetime so that I will know that someone else has benefited from my wealth.”

Warren Buffett

In conclusion, Warren Buffett’s philantrhropic efforts in 2020 demonstrate his continued commitment to giving back to society. Through the Giving Pledge campaign, Buffett has inspired countless other wealthy individuals to donate significant portions of their wealth to charitable causes, making a lasting impact on the world.

Answers to Common Questions

What are Warren Buffett’s core principles of value investing?

Buffett’s core principles hinge on two key factors: buying underpriced companies with strong financials and holding them for extended periods to ride out market fluctuations.

Which investment categories does Warren Buffett typically prefer?

Buffett’s portfolio is characterized by a strong bias towards equities, insurance companies, and conglomerates.

How does Warren Buffett allocate his investments across various asset classes?

Buffett typically allocates about 50% of his portfolio to equities, 30% to fixed-income securities, and 20% to derivatives and other investments.

Can you provide some examples of Warren Buffett’s most successful investments?

Some notable examples include his acquisition of Coca-Cola, American Express, and Wells Fargo, as well as his stake in Apple and Coca-Cola.

Is Warren Buffett involved in philanthropic efforts?

Yes, Buffett has been a long-time advocate for charitable giving, donating billions to the Bill and Melinda Gates Foundation and pledging to give away the majority of his fortune during his lifetime.

How does Warren Buffett’s wealth compare to other billionaires?

According to Forbes, Buffett’s net worth surpassed that of Bill Gates and Jeff Bezos in 2020, solidifying his position as one of the wealthiest individuals on the planet.