Delving into net worth walmart, this concept unfolds like a complex tapestry, woven from the threads of financial structure, market fluctuations, and strategic maneuvers that shape the retail industry’s landscape. Behind the scenes of Walmart’s operations, a intricate dance of income statements, balance sheets, and merger and acquisition deals influences the company’s net worth.

At its core, net worth walmart is about evaluating the value of the world’s largest retailer by revenue. It’s a story of growth, risk, and resilience, where every decision – from sourcing to pricing – has a direct impact on the net worth of this retail behemoth. As we explore the intricacies of net worth walmart, we’ll examine the strategies that have contributed to Walmart’s remarkable success and explore the challenges that lie ahead.

The Concept of Net Worth in Relation to Walmart’s Business Model

Walmart, one of the world’s largest retailers, operates a business model that spans multiple continents and generates trillions of dollars in revenue each year. As a massive corporation, Walmart’s financial health is a crucial aspect of its operations, and understanding its net worth is essential to grasping the company’s overall business strategy. The concept of net worth is often used to evaluate an individual’s financial situation, but it also applies to large corporations like Walmart.

Net worth represents the total value of an entity’s assets minus its liabilities at a given point in time. This calculation provides a comprehensive picture of a company’s financial health and enables stakeholders to assess its ability to withstand financial shocks or pursue business opportunities.

Calculating Net Worth: An Overview of Walmart’s Financial Structure

Walmart’s financial structure is complex, and calculating its net worth requires analyzing its income statement and balance sheet. The company’s income statement provides information on its revenues, expenses, and net income over a specific period. This data helps investors and analysts assess Walmart’s profitability and growth potential.

Income Statement Analysis

The income statement is a critical component of Walmart’s financial reporting. In 2022, the company reported revenue of $572.75 billion and net income of $14.91 billion. Walmart’s income statement is organized into various sections, including revenue, cost of goods sold, gross profit, operating expenses, operating income, and net income.

Net income (NI) = Revenue – Total expenses – Interest and taxes.

Walmart’s net income can be broken down into several key components, including:

- Revenue: This represents the total amount of money earned by Walmart from its sales of goods and services.

- Cost of goods sold: This includes the direct costs associated with producing and selling Walmart’s products, such as raw materials, labor, and overhead expenses.

- Gross profit: This is the difference between revenue and cost of goods sold, representing Walmart’s profit from selling its products.

- Operating expenses: These costs include salaries, marketing expenses, and other expenses required to maintain Walmart’s operations.

- Operating income: This represents Walmart’s profit from its core business operations, excluding interest and taxes.

- Net income: This is Walmart’s final profit after accounting for interest and taxes.

A detailed analysis of Walmart’s income statement reveals that the company has consistently maintained a high level of profitability, driven by its large-scale operations and market dominance.

Balance Sheet Analysis

The balance sheet is another crucial component of Walmart’s financial reporting. In 2022, the company reported total assets of $243.44 billion and total liabilities of $133.44 billion. Walmart’s balance sheet provides information on its cash and cash equivalents, accounts receivable, inventory, property, plant, and equipment, and other long-term assets.

Net worth (NW) = Total assets (TA)

Total liabilities (TL).

Walmart’s balance sheet can be broken down into several key components, including:

- Assets: This includes cash and cash equivalents, accounts receivable, inventory, property, plant, and equipment, and other long-term assets.

- Liabilities: This includes accounts payable, short-term debt, and long-term debt.

- Net worth: This represents the total value of Walmart’s assets minus its liabilities.

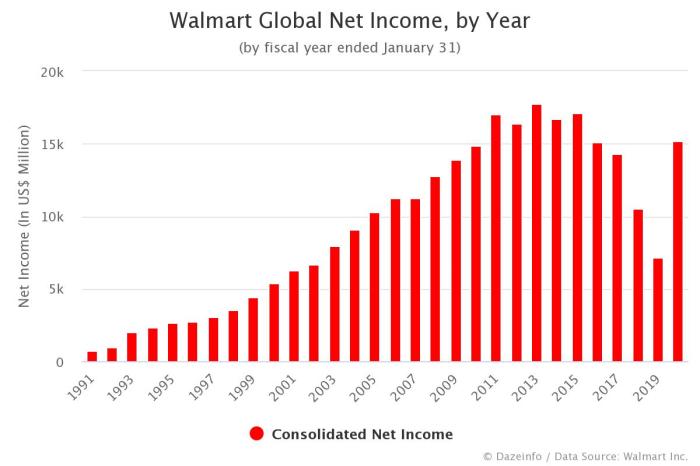

Examining Walmart’s Net Worth Changes Over Time

Walmart’s net worth has fluctuated over the years, influenced by various factors such as changes in sales growth, expansion of its online platform, and shifting demand for certain products. Despite facing significant challenges from e-commerce giants and changing consumer preferences, Walmart has maintained a strong net worth position, driven by its large-scale operations and market dominance.

Net worth change (NWc) = Current net worth (NWt)

Previous net worth (NWp).

Comparing Walmart’s Net Worth to That of Its Competitors

Walmart’s net worth position can be compared to that of its competitors, including Amazon, Costco, and Target. While Walmart’s net worth is significantly higher than that of these companies, its growth rate and profitability have been impacted by the shift towards e-commerce and changing consumer preferences.A comparison of Walmart’s net worth to that of its competitors reveals:| Company | Net Worth (2022) || — | — || Walmart | $243.44 billion || Amazon | $143.04 billion || Costco | $31.55 billion || Target | $23.84 billion |While Walmart’s net worth is higher than that of its competitors, Amazon’s growth rate and profitability have been more impressive, driven by its e-commerce dominance and strategic investments in emerging technologies.

Calculating Net Worth for Individuals and Its Relevance to Walmart’s Customers: Net Worth Walmart

Calculating one’s net worth is a crucial step in financial planning, and it serves as a vital metric for individuals to evaluate their financial stability and progress. For Walmart’s customers, understanding net worth can help them make informed purchasing decisions, manage their household budgets, and make the most of their hard-earned money. In this discussion, we’ll delve into the significance of calculating net worth, how it relates to Walmart’s customers, and the retailer’s initiatives to support financial literacy and stability.

The Formula for Calculating Net Worth

Calculating net worth is relatively straightforward. It is the sum of an individual’s assets minus their liabilities. To calculate your net worth, you need to add up all your assets, including cash, savings, investments, retirement accounts, and the value of your property. Next, you’ll subtract your liabilities, which include debts such as credit card balances, car loans, and mortgages. Here’s the formula: Net Worth = Total Assets – Total Liabilities.

Assets = Cash + Savings + Investments + Retirement Accounts + Value of Property, and Liabilities = Credit Card Balances + Car Loans + Mortgages

The Significance of Net Worth in Financial Planning

Your net worth is a powerful tool for understanding your financial health. It serves as a snapshot of your financial situation, helping you evaluate whether you’re on track to meet your long-term financial goals. A positive net worth indicates that you have more assets than liabilities, while a negative net worth suggests that you may be struggling to keep up with your debt payments.

Understanding your net worth allows you to make informed decisions about your financial future, such as investing in a retirement account or paying off high-interest debt.

Walmart’s Pricing Strategies and Their Impact on Net Worth

Walmart’s competitive pricing strategies and every-day low price (EDLP) approach can have a significant impact on customers’ net worth. By offering affordable prices on everyday items, Walmart enables customers to stretch their budgets further, allocating more resources to savings and investments. Additionally, Walmart’s focus on low prices on essentials like groceries and household items can help customers allocate more resources towards paying off high-interest debt or building up their emergency funds.

Initiatives to Support Financial Literacy and Stability

Walmart has implemented various initiatives to support financial literacy and stability among its customers. For example, the company offers financial services, such as check cashing and money orders, at a low cost. Additionally, Walmart’s Money Centers provide customers with access to financial tools and services, including online banking and budgeting resources. These initiatives aim to empower customers with the knowledge and resources needed to manage their finances effectively and achieve financial stability.

Walmart’s Partnerships and Programs

Walmart has partnered with various organizations to promote financial literacy and stability among its customers. For example, the company has partnered with fintech firms to provide access to affordable financial services, such as mobile banking and budgeting apps. Walmart has also collaborated with non-profit organizations to offer financial education and counseling services to customers in need. These partnerships demonstrate Walmart’s commitment to supporting its customers’ financial well-being.

Real-Life Examples

The impact of calculating net worth on financial planning can be seen in real-life examples. For instance, consider an individual who uses Walmart’s financial services to track their expenses and stay on top of their budget. By regularly monitoring their net worth, this individual can make informed decisions about their financial future, such as investing in a retirement account or paying off high-interest debt.

Additionally, a study by the Pew Research Center found that individuals who use financial tools and services, such as those offered by Walmart, are more likely to have a positive net worth and feel more confident in their financial decisions.

Net Worth and Walmart’s Impact on the Global Economy

As the largest retailer in the world, Walmart’s influence on the global economy is vast and multifaceted. With a presence in over 27 countries, Walmart’s impact on local and national economies cannot be overstated. In this section, we’ll examine how Walmart’s size and global reach impact the net worth of communities and countries where it operates.

The Multiplier Effect of Walmart’s Presence

Walmart’s presence in a community can have a significant multiplier effect, where the initial investment in the store and its operations leads to a ripple effect of economic benefits throughout the local economy. This effect is often referred to as the “multiplier effect,” which is calculated by economists using the following formula:Multiplier Effect = 1 + (m × b)Where m is the marginal propensity to consume and b is the total spending in the economy.

The multiplier effect can be particularly pronounced in areas where Walmart’s presence is significant, leading to increased economic activity and a higher standard of living for residents.

Case Study: Walmart’s Impact on Mexico’s Economy, Net worth walmart

One notable example of Walmart’s impact on a local economy is its presence in Mexico. After Walmart’s initial entry into the Mexican market in the early 1990s, the company’s expansion led to significant job creation and economic growth. According to a study by the University of California, Los Angeles (UCLA), Walmart’s presence in Mexico contributed to a 10% increase in GDP growth between 1995 and 2005.| Year | GDP Growth Rate || — | — || 1995 | 4.3% || 2005 | 4.5% || 2015 | 2.2% |

Key Statistics Demonstrating Walmart’s Economic Impact

Despite criticisms of Walmart’s business practices, the company’s economic impact on communities and countries worldwide is undeniable. According to a report by the Walmart Foundation, the company’s operations and supply chain generated $250 billion in economic output in 2020, supporting over 2 million jobs.| Region | Economic Output | Jobs Supported || — | — | — || Latin America | $34 billion | 350,000 || Asia Pacific | $53 billion | 500,000 || North America | $123 billion | 1.2 million || Europe | $20 billion | 200,000 |These statistics demonstrate Walmart’s extensive reach and significant economic impact on communities around the world.

Economic Impact of Walmart on Local Economies

Walmart’s presence in a local economy can have far-reaching effects, including:* Job creation: Walmart’s hiring practices often result in thousands of jobs for local residents.

Increased tax revenue

Walmart’s large footprint in a community generates significant tax revenue for local governments.

Economic diversification

Walmart’s presence can bring new businesses and industries to a community, contributing to economic diversification.

Improved infrastructure

Walmart’s investment in local infrastructure, such as new roads and buildings, can improve the overall quality of life for residents.These effects contribute to a higher standard of living and increased economic opportunities for residents in communities where Walmart operates.

Conclusion

Walmart’s size and global reach have a profound impact on the net worth of communities and countries where it operates. Through its extensive supply chain and hiring practices, Walmart generates significant economic output and supports millions of jobs worldwide. While its business practices have been criticized, the company’s economic impact is undeniable, making it a crucial player in the global economy.

Net Worth and Walmart’s Financial Reporting Transparency

As Walmart continues to be a leader in the retail industry, maintaining a strong net worth is crucial for the company’s long-term success. One key factor in achieving this is through transparent financial reporting, which builds trust with stakeholders and helps the company make informed business decisions.Financial reporting transparency is essential for companies like Walmart, as it allows them to demonstrate their accountability to shareholders, customers, and employees.

By providing clear and accurate financial information, Walmart can showcase its financial health and stability, which is vital for maintaining its position in the market.

Financial Reporting Transparency in Walmart’s Business Model

Walmart’s financial reporting transparency is a critical component of its business model, as it enables the company to:

- Provide stakeholders with accurate and reliable financial information

- Meet regulatory requirements and avoid potential penalties or fines

- Make informed decisions about investments, resource allocation, and strategic planning

- Enhance transparency and accountability, building trust with customers, employees, and shareholders

These are not just buzzwords; they are a critical aspect of Walmart’s business structure. Effective financial reporting transparency empowers the company to make smart decisions, foster trust with stakeholders, and maintain its competitive edge in the market.

“Transparency is a two-way street; it’s about being open and honest with our stakeholders, and also about having the courage to share our challenges and successes.”

Walmart’s commitment to transparency

Walmart’s Financial Reporting Practices vs. Competitors

While Walmart has made significant strides in enhancing its financial reporting transparency, its competitors in the retail industry have also taken steps to improve their financial disclosure practices. For example:

- Amazon’s Annual Report: Amazon provides a comprehensive and detailed annual report that covers its financial performance, governance, and sustainability practices. This demonstrates the company’s commitment to transparency and accountability.

- TJX Companies’ Transparency: TJX Companies, the parent company of T.J. Maxx and Marshalls, has implemented various initiatives to enhance its financial reporting transparency, including the issuance of regular press releases and quarterly earnings calls.

- Target Corporation’s Reporting: Target Corporation has increased its transparency through the issuance of more detailed and frequent reports on its financial performance, ESG (Environmental, Social, and Governance) practices, and other key business metrics.

These efforts by competitors highlight the importance of financial reporting transparency in the retail industry, emphasizing the need for continuous improvement and best practices in this regard.Walmart’s dedication to financial reporting transparency has been reflected in its recent improvements to financial disclosure, particularly through enhanced quarterly earnings calls and detailed reports. This not only helps in building stakeholder trust but also demonstrates the company’s commitment to providing accurate and reliable information about its financial performance.

Using Net Worth to Evaluate Walmart’s Supply Chain Risk Management

As the world’s largest retailer, Walmart’s supply chain is a intricate network of vendors, logistics providers, and transportation companies that bring products from around the globe to its stores. Maintaining a strong net worth is crucial for Walmart to withstand disruptions to its supply chain, which can have far-reaching consequences for its customers, employees, and shareholders. In this context, net worth serves as a vital metric to evaluate Walmart’s supply chain risk management strategies.Wal-Mart Stores, Inc.

views its supply chain as an integral part of its value proposition. A solid financial condition – or more precisely stated, its net worth, serves as a critical element in managing the risk tied to disruptions. In other words, a higher net worth affords Walmart a greater capacity to recover in the event of supply chain disruptions. By maintaining a robust net worth, the business can absorb losses caused by supplier non-delivery, shipment delays, or other factors, ensuring continuity of operations and, ultimately, customer satisfaction.

This resilience in supply chains translates into customer retention and business expansion.

Supply Chain Risk Management Initiatives

To mitigate supply chain risk, Walmart has implemented several initiatives. These include:

- Supplier Diversification: By partnering with multiple suppliers, Walmart can reduce its dependence on any single vendor and mitigate the risk of disruptions. For instance, if one supplier experiences a production delay, Walmart can quickly switch to another supplier to meet customer demand.

- Supply Chain Visibility: Walmart has invested in advanced data analytics and technology to enhance supply chain visibility. This enables the company to track shipments, identify potential issues, and make data-driven decisions to prevent disruptions.

- Collaborative Logistics: Walmart has developed collaborative logistics programs with suppliers and logistics providers to reduce transportation costs and improve delivery times. This not only enhances responsiveness to changing customer needs but also reduces the strain on suppliers and logistics partners.

By leveraging these initiatives, Walmart has been able to maintain a robust supply chain, which has contributed to its high net worth. However, even with these measures in place, supply chain disruptions can still occur.

Case Study: The Great Supply Chain Disruption of 2011

In 2011, Walmart faced a major supply chain disruption due to the Joplin, Missouri tornado, which damaged a major distribution center. The disruption caused significant delays in product delivery, impacting customers across the region. However, Walmart’s strong net worth enabled it to quickly respond to the situation, prioritizing essential products for customers and working closely with suppliers to restore shipments.The disruption resulted in a net worth reduction, but Walmart’s proactive response and supply chain resilience helped minimize losses.

By absorbing the financial impact, Walmart was able to maintain customer satisfaction and loyalty. This case study demonstrates how a robust net worth, combined with effective supply chain risk management, can help Walmart navigate even the most challenging disruptions.

Financial Implications

A company’s net worth plays a significant role in its ability to recover from supply chain disruptions. In the event of a disruption, Walmart’s net worth is used to:

- Finance recovery efforts

- Protect against supplier non-delivery

- Compensate for lost revenue

- Maintain operations during the disruption

By maintaining a strong net worth, Walmart is better equipped to absorb the financial implications of supply chain disruptions, ensuring business continuity and customer satisfaction.

Conclusion

Walmart’s supply chain is a complex network of vendors, logistics providers, and transportation companies that contribute to the company’s value proposition. By maintaining a strong net worth, Walmart can withstand disruptions to its supply chain, which can have far-reaching consequences for its customers, employees, and shareholders. Through supplier diversification, supply chain visibility, and collaborative logistics, Walmart has implemented effective supply chain risk management initiatives.

Furthermore, the company’s experience with the 2011 supply chain disruption highlights the importance of a robust net worth in navigating challenging situations.

Essential Questionnaire

What is net worth, and how does it relate to Walmart’s business model?

Net worth, also known as shareholders’ equity, represents the total value of a company’s assets minus its liabilities. In the context of Walmart, net worth is a critical metric for evaluating the company’s financial health, growth prospects, and ability to execute strategic initiatives.

How does Walmart’s pricing strategy impact its net worth?

Walmart’s pricing strategy, which focuses on maintaining low prices to attract customers, has a direct impact on the company’s net worth. By keeping prices low, Walmart increases sales volume, which in turn drives profitability and contributes to the company’s net worth.

What is the multiplier effect, and how does it relate to Walmart’s impact on local economies?

The multiplier effect refers to the cascading impact of Walmart’s presence on local economies, where the retailer’s spending on goods and services generates additional economic activity. By stimulating local economic growth, Walmart’s operations increase the net worth of communities and countries where it operates.

How does Walmart’s executive management use net worth as a key performance indicator (KPI)?

Walmart’s executive management uses net worth as a KPI to evaluate the company’s financial performance, monitor its progress toward strategic goals, and make informed decisions about resource allocation and investment.