How well am I doing financially for my age is not just a question – it’s a quest for answers that will change the course of your financial future. It’s a tale of trial and error, of setbacks and comebacks, of financial fiascos and fiscal prudence. And it’s a story that begins with you, now, at the threshold of a new decade of life.

Your 20s are the springboard to adulthood, a time of self-discovery and financial formation.

By your 20s, you’ve likely accumulated some debt, either from student loans or credit cards, and you’re struggling to make ends meet. You’re not sure if you’re on the right track financially, or if you’re just winging it. That’s where our exploration of financial health based on age groups comes in – to guide you through the twists and turns of your financial journey.

Assessing Financial Health Based on Age Groups

Financial health is a crucial aspect of our lives, and it’s essential to understand how it changes across different age groups. From the early twenties to the senior years, individuals face unique financial challenges that can impact their overall well-being. In this discussion, we’ll explore the typical financial characteristics of various age groups, the changes that occur, and the societal expectations and cultural norms that influence financial decision-making.As we navigate through life, our financial priorities and goals shift significantly.

Young adults, typically between the ages of 20 and 30, often focus on paying off student loans, building their credit scores, and establishing a career. This age group is prone to financial impulsivity, with a high propensity for credit card debt and impulsive purchases. A survey by the American Psychological Association found that 47% of millennials aged 24-38 reported using credit cards for discretionary spending.

This reckless spending can lead to financial instability and stress.

Career Establishments and Debt Repayment (20s-30s)

Young adults are more likely to take on debt than older age groups, primarily to finance higher education or career advancement. The financial burden of high-interest loans, credit cards, and mortgages can be overwhelming. According to NerdWallet, the average student loan debt for the class of 2020 was $31,300. This heavy financial load can impact long-term financial goals, such as buying a home or retirement savings.Financial institutions and government policies play a crucial role in shaping financial health during this age group.

For instance, programs like income-driven repayment plans for student loans can offer relief to borrowers with excessive debt. Similarly, employer-sponsored 401(k) plans can provide opportunities for retirement savings.As individuals transition into their thirties and forties, financial priorities shift toward family planning, mortgage payments, and retirement savings. The financial stability of this age group often enables them to make more informed decisions about investments and long-term planning.

However, the challenges of midlife crises, health issues, and aging parents can arise, requiring significant financial adjustments.

Familial and Retirement Planning (40s-50s)

In their forties and fifties, individuals often face increased financial responsibilities, such as caring for aging parents or supporting grown children. According to a 2020 report by the Genworth Financial Corporation, 70% of baby boomers (born between 1946 and 1964) reported providing financial support to family members. This added financial burden can lead to stress and financial strain.As people approach retirement age, they often require significant financial resources to maintain a comfortable standard of living.

According to a report by the Employee Benefit Research Institute (EBRI), at least 60% of workers expect to retire in the next 10-20 years. Ensuring a steady income stream and managing expenses during retirement becomes a critical aspect of financial planning for this age group.

Rental Income and Retirement Income Streams (60s-70s)

In their sixties and seventies, individuals may opt for alternative income streams, such as renting out a spare home or investing in rental properties. According to data from Zillow, the average rent for a single-family home in the United States was $1,450 in 2020. By leveraging rental income, seniors can supplement their retirement income and maintain a higher standard of living.As we age, societal expectations and cultural norms play a significant role in shaping financial decision-making.

For instance, the notion that retirees should live modestly and prioritize health care expenses can lead to financial strain. However, some countries prioritize elder financial security through programs like the Canadian Old Age Security Pension.

A 2020 report by the United States Social Security Administration found that among workers aged 65 and older, 70% of men and 80% of women rely on social security as a primary source of income.

Cultural Norms and Retirement Planning

Cultural norms can significantly impact financial planning for retirement. For example, the concept of “saving for a rainy day” may not apply to cultures where extended family support is a norm. According to a 2019 OECD report, 40% of adults in Sweden reported having no retirement savings, but they also reported relying heavily on public pensions and other forms of support.In conclusion, financial health changes significantly across age groups due to shifts in priorities, goals, and societal pressures.

Understanding these changes is crucial for individuals, policymakers, and financial institutions to implement tailored support and guidance.

Evaluating Financial Progress in Your 20s

Navigating the complexities of personal finance in your 20s can be a challenging yet rewarding experience. This decade is marked by significant financial milestones, including establishing a career, paying off student loans, and developing good credit habits. Unfortunately, many young adults make common financial mistakes that can have long-term consequences, such as accumulating high-interest debt, neglecting retirement savings, and failing to build an emergency fund.The key to achieving financial stability in your 20s is to establish a solid foundation that will serve you well throughout your life.

This begins with understanding your financial goals and creating a plan to achieve them. Developing good money management habits, such as saving and investing consistently, will help you build wealth over time and achieve financial independence.

Common Financial Mistakes in Your 20s

Many young adults face financial challenges in their 20s due to a lack of financial literacy. Here are some common pitfalls to avoid:

- Accumulating high-interest debt: Credit card debt can quickly spiral out of control if not managed properly. Make sure to pay off your credit card balances in full each month or consider a balance transfer to a lower-interest loan.

- Neglecting retirement savings: Retirement may seem like a distant concern, but every year you delay saving for retirement means less time for your money to grow. Contribute as much as possible to a 401(k) or IRA to take advantage of compound interest.

- Failing to build an emergency fund: A financial emergency can strike at any time, leaving you without a safety net. Aim to save 3-6 months’ worth of living expenses in a readily accessible savings account.

- Prioritizing short-term wants over long-term needs: While it’s tempting to splurge on lifestyle upgrades, remember that short-term wants can compromise your long-term financial goals. Prioritize needs over wants and make smart financial choices.

- Not reviewing and adjusting your budget regularly: Financial situations can change rapidly, so it’s essential to review your budget regularly and adjust your spending habits accordingly.

Establishing an Emergency Fund and Retirement Savings

A solid financial foundation begins with an emergency fund and retirement savings plan. These two funds are essential for achieving long-term financial stability and security.

An emergency fund is a cushion that protects you from financial shocks, such as job loss, medical emergencies, or car repairs.

Creating an emergency fund involves setting aside a portion of your income in a readily accessible savings account. As a rule of thumb, aim to save 3-6 months’ worth of living expenses in your emergency fund.

Retirement savings is a long-term investment that allows you to build wealth over time and achieve financial independence.

Starting early is crucial for retirement savings. Contribute as much as possible to a 401(k) or IRA, and take advantage of compound interest to grow your retirement portfolio.

Prioritizing Financial Goals and Allocating Resources Effectively

Financial priorities can change over time, so it’s essential to regularly review and adjust your financial goals and resource allocation. Here’s a framework to help you prioritize your financial goals and allocate resources effectively:

| Financial Goal | Priority Level (1-3) | Current Allocation | Target Allocation |

|---|---|---|---|

| Emergency Fund | 1 | < 3 months’ worth of living expenses | ≥ 3-6 months’ worth of living expenses |

| Retirement Savings | 2 | < 10% of income | ≥ 10-15% of income |

| Debt Repayment | 3 | High-interest debt > 2 years old | Low-interest debt < 1 year old |

By following this framework, you can prioritize your financial goals and allocate resources effectively to achieve long-term financial stability and security.

Case Study: Achieving Financial Stability in Your 20s

Meet Sarah, a 25-year-old who successfully managed her finances in her 20s. Sarah started saving for retirement at age 22 and contributed 10% of her income to a 401(k). She also built an emergency fund by setting aside 3 months’ worth of living expenses in a readily accessible savings account.Sarah prioritized her financial goals by focusing on needs over wants.

She reduced her lifestyle upgrades and allocated her remaining income towards debt repayment and savings. By doing so, Sarah was able to pay off her student loans in 2 years and built a significant amount of savings and retirement portfolio.Sarah’s story serves as a testament to the importance of financial literacy and responsible money management. By avoiding common financial mistakes and creating a solid financial foundation, you can achieve financial stability and security in your 20s and set yourself up for success in the long term.

Strategies for Financial Growth in Your 40s and 50s

As you navigate the complexities of middle age, managing multiple financial responsibilities becomes increasingly crucial. From mortgage payments to college tuition, it’s essential to strike a balance between short-term needs and long-term goals. In this section, we’ll examine strategies for optimizing your financial trajectory, including investment portfolio management, estate planning, and achieving long-term objectives.

Managing Multiple Financial Responsibilities

In your 40s and 50s, you may be juggling mortgage payments, college tuition for your children, and savings for retirement. Here’s a breakdown of the key financial responsibilities you should be focused on:

- Mortgage Payments: Your monthly mortgage payment is a significant expense that you should prioritize. As you approach retirement, consider the pros and cons of paying off your mortgage versus investing in other assets.

- College Tuition: If you have children in college or plan to have them attend in the future, prioritize saving for tuition and other education expenses.

- Retail Savings: Allocate a portion of your income towards retirement savings, taking into account the employer match on your 401(k) or similar retirement account. This can provide tax benefits and compound interest, growing your savings over time.

Managing these responsibilities effectively requires careful budgeting and planning. You may need to reassess your spending habits, adjust your investment portfolio, or explore alternative loan options. Consider the importance of maintaining a cushion for unexpected expenses and avoiding unnecessary debt.

Optimizing Investment Portfolios for Retirement Savings

Investing in a diversified portfolio can help maximize your retirement savings while minimizing risk. As you approach midlife, reevaluate your investment mix to ensure it aligns with your changing goals. Here are some key considerations:

- Diversification: Aim for a well-rounded portfolio with a mix of stocks, bonds, and other assets. This can help protect your investments from market downturns and ensure steady growth over time.

- Tax-Efficient Investing: Prioritize tax-deferred accounts, such as 401(k) or IRA, for retirement savings. These accounts offer tax benefits that can help your investments grow faster.

- Index Funds and ETFs: Consider investing in index funds or ETFs, which track the performance of a specific market index, such as the S&P 500. These funds can offer broad diversification and lower fees compared to actively managed funds.

It’s essential to regularly review and rebalance your portfolio to ensure it remains aligned with your changing investment goals and risk tolerance. Consult with a financial advisor or investment professional to develop a tailored strategy.

The Importance of Estate Planning and Creating a Will, How well am i doing financially for my age

As you approach middle age, it’s crucial to have a plan in place for the distribution of your assets after your passing. Estate planning involves more than just creating a will; it’s about ensuring your wishes are respected and providing for the well-being of your loved ones. Here are key considerations:

- Last Will and Testament: A will Artikels how your assets will be distributed among your beneficiaries. It’s essential to update your will every 5-10 years to reflect changes in your life, such as marriage, divorce, or the birth of children.

- Powers of Attorney: Designate a trusted individual to manage your financial and healthcare decisions if you become incapacitated. This ensures your wishes are respected and reduces the burden on your loved ones.

- Beneficiary Designations: Review and update the beneficiary designations for your retirement accounts, life insurance policies, and other assets. This will ensure your assets are distributed according to your wishes after your passing.

Don’t underestimate the importance of having a clear plan in place. Consider consulting with an attorney specializing in estate planning to create a comprehensive strategy tailored to your needs.

Organizing a Timeline for Achieving Long-Term Financial Goals

Creating a timeline for achieving your long-term financial goals can help you stay focused and motivated. Consider the following milestones:

- Midlife Review (45-50): Reassess your investment portfolio, update your will, and review your financial goals to ensure alignment with your changing priorities.

- Retail Savings Acceleration (50-55): Intensify your retirement savings efforts, taking advantage of tax benefits and compound interest to grow your nest egg.

- Legacy Planning (55+): Review your estate plan, update your will, and consider charitable giving to ensure your legacy is preserved.

By following this timeline and addressing the challenges of managing multiple financial responsibilities, optimizing your investment portfolio, and implementing estate planning, you can navigate the complexities of middle age with confidence and achieve your long-term financial goals.

Preparing for Retirement and Long-Term Care

When it comes to securing your financial future, planning for retirement and long-term care is crucial. Retirement savings should cover essential expenses, medical costs, and other unexpected events, ensuring a comfortable and worry-free life. Long-term care planning involves anticipating and preparing for potential healthcare needs, ensuring access to quality services when needed.

Calculating Retirement Needs

Retirement needs vary significantly depending on factors like desired lifestyle, inflation, and life expectancy. To calculate your retirement needs, consider the following steps:* Estimate your annual expenses in retirement, including housing, food, healthcare, and entertainment.

- Account for inflation by factoring in a 2-3% annual increase in expenses.

- Consider your life expectancy and potential healthcare needs, including potential long-term care costs.

Use the 70% rule

assume you’ll need 70% of your pre-retirement income to maintain a similar standard of living in retirement.

To illustrate this, let’s consider an example. John, a 40-year-old marketing manager, estimates his annual expenses in retirement at $60,000. Assuming a 2% annual inflation rate and a life expectancy of 85, John’s projected expenses over 20 years would total approximately $1.43 million. Using the 70% rule, John would need to save around $1 million to cover 70% of his estimated expenses.

Creating a Sustainable Income Stream

A well-structured retirement income stream should balance growth, income, and tax efficiency. Consider the following strategies:* Diversify your investments to minimize risk and maximize returns.

- Utilize tax-deferred retirement accounts, such as 401(k) or IRA, to reduce tax liabilities.

- Create a sustainable withdrawal strategy, focusing on 4-5% annual withdrawals from your retirement portfolio.

- Consider annuities or dividend-paying stocks to generate regular income.

The following table highlights different retirement account options and their characteristics:| Account Type | Contribution Limits | Tax Benefits | Flexibility || — | — | — | — || 401(k) | $19,500 (2023) | Tax-deferred | Employer matching || IRA | $6,000 (2023) | Tax-deferred | No employer matching || Roth IRA | $6,000 (2023) | Tax-free withdrawals | No employer matching || Annuities | Varies by provider | Tax-deferred or tax-free | Fixed or variable income |

Importance of Long-Term Care Planning

Long-term care planning involves anticipating and preparing for potential healthcare needs, ensuring access to quality services when needed. Consider the following key points:* Long-term care costs can be substantial, with median annual costs exceeding $90,000.Long-term care insurance can help cover unexpected healthcare expenses, ensuring access to quality services when needed.

Consider the following long-term care options

home care, adult day care, assisted living, and skilled nursing facilities.

The following table highlights the average annual costs of different long-term care options:| Service Type | Average Annual Cost (2023) || — | — || Home Care | $49,000 || Adult Day Care | $18,000 || Assisted Living | $51,000 || Skilled Nursing Facilities | $102,000 |

Building Multiplication Effect Through Smart Financial Investments: How Well Am I Doing Financially For My Age

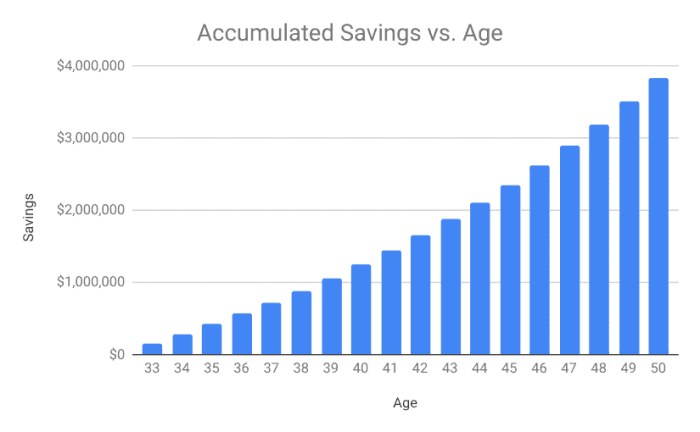

Smart financial investments can make a significant difference in your financial journey, creating a snowball effect that propels you toward your long-term goals. The concept of compound interest is a powerful tool that can help you achieve impressive returns, but it requires a solid understanding of how it works.Compound interest is a mathematical phenomenon where the interest on a principal amount is calculated and added to the principal, making it grow exponentially over time.

For instance, if you invest $1,000 with a 5% annual interest rate, you can expect to earn $50 in interest in the first year, bringing your total balance to $1,050. In the second year, the interest rate is applied to the new principal of $1,050, earning you $52.50 in interest, and so on. As you can see, the power of compound interest lies in its ability to multiply your initial investment over time.

The Impact of Compound Interest on Long-Term Investments

As the years go by, the difference between a modest investment and a highly compound interest can be staggering. The table below illustrates the growth of a $10,000 investment over a 20-year period, assuming a 5% annual interest rate.| Year | Balance || — | — || 1 | $10,525 || 5 | $13,463 || 10 | $17,322 || 15 | $22,551 || 20 | $30,439 |The exponential growth of your investment is a testament to the power of compound interest.

By taking advantage of this phenomenon, you can create a substantial nest egg over time, providing you with financial freedom and security.

Exploring Different Investment Options

When it comes to smart financial investments, diversification is key. You want to spread your investments across different asset classes to minimize risk and maximize returns. Here are some popular investment options to consider:### StocksStocks are a popular choice for investors, offering the potential for high returns over the long-term. By buying shares of publicly traded companies, you become a shareholder and can benefit from dividend payments and capital appreciation.

- Blue-chip stocks: These are shares of well-established, profitable companies with a history of paying consistent dividends.

- Growth stocks: These are shares of companies that are expected to experience high growth rates, often in emerging industries.

- Dividend stocks: These are shares of companies that pay regular dividend payments, providing a relatively stable source of income.

### BondsBonds are debt securities that represent a loan to a borrower, typically a corporation or government entity. By purchasing bonds, you essentially lend money to the issuer, who promises to pay you back with interest.

- Government bonds: These are bonds issued by national governments, offering a relatively low-risk investment opportunity.

- Corporate bonds: These are bonds issued by companies to raise capital, often offering higher interest rates to attract investors.

- Municipal bonds: These are bonds issued by local governments or municipalities to finance public projects, offering tax-free interest payments.

### Real EstateReal estate investments involve buying, renting, or selling properties to generate income or profit. This can be a lucrative option, but it also requires significant upfront capital and hands-on management.

- Rental income: By renting out properties, you can generate passive income through rental payments.

- Property appreciation: As property values increase over time, you can sell your properties for a profit.

- Rehabilitation: Investing in distressed properties and renovating them to sell for a profit can be a lucrative strategy.

Choosing the Right Investment Strategy: Actively Managed vs. Index Funds

When it comes to investing in the stock market, you have two primary options: actively managed funds and index funds. Actively managed funds involve a professional manager making trades to beat the market average, while index funds track a specific market index, such as the S&P 500.### Actively Managed Funds* Pros: + Potential for higher returns through skilled management + Flexibility to adjust portfolio composition

Cons

+ Higher fees and expenses + Risk of underperforming the market### Index Funds* Pros: + Lower fees and expenses + Tracks a specific market index for diversified exposure

Cons

+ May not keep pace with actively managed funds + Limited flexibility in portfolio composition

Designing a Diversified Investment Portfolio

A well-diversified portfolio should include a mix of different asset classes to minimize risk and maximize returns. Consider allocating your investments among the following categories:

Asset Allocation: 40% Stocks, 30% Bonds, 30% Real Estate

| Category | Allocation | Example Investments || — | — | — || Stocks | 40% | Blue-chip stocks, growth stocks, dividend stocks || Bonds | 30% | Government bonds, corporate bonds, municipal bonds || Real Estate | 30% | Rental income properties, property appreciation, rehabilitation |By diversifying your investments and taking advantage of compound interest, you can create a robust portfolio that generates consistent returns over the long-term.

FAQ Compilation

Q: How do I create a budget that actually works for me?

A: Start by tracking your income and expenses, then set financial goals and prioritize your spending. Use the 50/30/20 rule to allocate your income – 50% for necessities, 30% for discretionary spending, and 20% for savings and debt repayment.

Q: What’s the best way to pay off high-interest debt?

A: Consider a debt consolidation loan or balance transfer credit card, or try the debt snowball method, where you pay off debts with the smallest balances first.

Q: How can I build a solid emergency fund?

A: Aim to save 3-6 months’ worth of living expenses, and keep your emergency fund in a liquid, high-yield savings account.

Q: What investments should I consider for long-term growth?

A: Consider a mix of low-cost index funds and individual stocks, with a focus on diversification and long-term potential.

Q: How can I protect my income and assets from inflation?

A: Invest in assets that historically perform well in inflationary periods, such as real estate or precious metals, and consider dollar-cost averaging to smooth out market fluctuations.