Delving into the nuances of does a 401k count towards net worth, it becomes clear that this question is a vital one for individuals looking to make the most of their retirement savings. As we explore the ins and outs of 401ks and their impact on net worth, one thing becomes abundantly clear: understanding this dynamic is crucial for smart financial planning.

The inclusion of 401k plans in net worth calculations is often a contentious issue, with some experts advocating for their inclusion and others pushing back. But what does the data actually say? And how can individuals like you harness the power of 401k savings to drive their financial goals? In this comprehensive guide, we’ll dive into the nitty-gritty of 401ks and net worth, providing a clear-eyed examination of the role these retirement savings play in the bigger picture of personal finance.

Understanding the Basics of 401k Contributions for Net Worth Calculation

When it comes to saving for retirement and calculating net worth, a 401k is one of the most popular options. A 401k is a type of employer-sponsored retirement plan that allows employees to contribute a portion of their paycheck to a tax-deferred investment account. This contribution can significantly impact an individual’s net worth over time, and understanding the basics is essential.There are two primary types of 401k contributions: employee contributions and employer matching contributions.

Employee contributions are made directly from an employee’s paycheck, while employer matching contributions are made by the employer to match the employee’s contributions, up to a certain limit.

Types of 401k Contributions

Employees can contribute a portion of their paycheck to a 401k plan. The contribution limits vary each year, as determined by the IRS. For example, in 2023, the contribution limit is $20,500, with an additional $6,500 catch-up contribution allowed for those 50 years or older. The contribution is made through pre-tax dollars, reducing an individual’s taxable income.

Tax Implications of 401k Contributions, Does a 401k count towards net worth

The tax implications of 401k contributions are an essential aspect of understanding the basics. Employee contributions are made with pre-tax dollars, reducing an individual’s taxable income. The contribution is tax-deferred, meaning the taxes are paid when the funds are withdrawn in retirement. Employer matching contributions, on the other hand, are tax-free, as they are considered a form of compensation.

Employer Matching Contributions

Employer matching contributions are a crucial aspect of increasing net worth. These contributions are made by the employer to match the employee’s contributions, up to a certain limit. The employer’s matching ratio varies depending on the plan, typically ranging from 50% to 100% of the employee’s contributions. For instance, if an employee contributes 3% of their salary, the employer may match 50% of that contribution.

Importance of Employer Matching Contributions

Employer matching contributions are essential in increasing net worth. These contributions are essentially free money, as they do not come from the employee’s paycheck. By taking advantage of employer matching contributions, an employee can significantly boost their investment returns over time. For example, if an employee contributes 3% of their salary and the employer matches 50%, that’s an additional 1.5% of their salary going into their 401k account.

Real-Life Example

Let’s consider a real-life example. John contributes 5% of his $50,000 salary to his 401k plan. His employer matches 50% of his contributions, which amounts to $1,250. Over 20 years, this additional $1,250 in matching contributions can add up to a significant amount, assuming an average annual return of 7%. By leveraging employer matching contributions, John can potentially increase his net worth by tens of thousands of dollars over his working career.

| Scenario | Employee Contribution | Employer Matching Contribution |

|---|---|---|

| John contributes 5% of his salary | $2,500 | $1,250 (50% match) |

| John does not contribute to his 401k | $0 | $0 (no match) |

Factors Affecting the Count of 401k towards Net Worth: Does A 401k Count Towards Net Worth

The value of a 401k retirement plan can significantly impact one’s net worth, but various factors can influence its contribution to the total net worth. Employer matching, vested percentages, loan repayments, and hardship withdrawals all play crucial roles in determining the 401k contribution’s impact on net worth.A key factor affecting the count of 401k towards net worth is the vested percentage.

The vested percentage refers to the proportion of an employee’s 401k plan that is fully owned by the individual. For example, if an employee has a 50% vested percentage, they own 50% of the employer matching contributions and 50% of their own contributions. Employers often use a vesting schedule to determine when an employee’s contributions become fully vested. This schedule can vary but typically ranges from 2-6 years.

Employers may also require a minimum service period before the employer matching contributions are fully vested. The vested percentage impact on net worth can be seen when considering an example: If an employee has a 50% vested percentage and they contribute $1,000 to their 401k plan, while their employer matching contributes $500, only $250 (50% of $500) is added to their net worth, assuming no loans repayments.The role of employer matching in determining 401k contribution impact on net worth should not be underestimated.

Employer matching contributions are essentially free money, and the vesting schedule plays a crucial role in determining their contribution to net worth. Employers usually match a certain percentage of the employee’s contributions, ranging from 50% to 100%. For example, if an employer matches 50% of the employee’s contributions up to 6% of their salary, and the employee contributes 6% of their salary, the employer matching contributions would add 3% to the employee’s 401k plan.

Understanding the vesting schedule and employer matching percentage can help maximize the 401k contribution’s impact on net worth.Loan repayments also affect the calculation of 401k contribution. When an employee takes a loan from their 401k plan, the funds borrowed are typically deducted from the 401k balance. The employee must then repay the loan, along with interest, usually within a specified repayment period.

If the loan repayment period is 5 years, and the employee borrows $5,000 at an interest rate of 5%, the total repayment amount would be $5,312.50. The loan repayment impact on net worth can be significant, and employees should carefully consider the terms before taking a loan from their 401k plan.Hardship withdrawals can also impact the calculation of 401k contribution.

Hardship withdrawals are distributions made from a 401k or other retirement plan when an employee faces certain qualifying events, such as a qualified education expense or a mortgage transaction. The amount withdrawn is taxable as ordinary income and may also be subject to a penalty, except in cases of certain financial emergencies. Assuming a hardship withdrawal of $20,000 and considering the taxes and potential penalties, the net worth impact can range from 20% to 40%.

It’s essential to understand the specific circumstances and tax implications before making a hardship withdrawal.

| Vesting Schedule | Employer Matching | Loan Repayment | Hardship Withdrawal |

|---|---|---|---|

| Varies, 2-6 years minimum | Typically 50% to 100% | Up to 5 years repayment period | Taxable as ordinary income, potential penalties |

Tax and Estate Considerations for 401k and Net Worth

In the world of personal finance, the 401k plan has become a staple for many Americans, offering a tax-deferred way to save for retirement. However, amidst the benefits of a 401k plan, there are crucial tax and estate implications to consider, which can significantly impact one’s net worth.Tax-deferred growth is one of the primary benefits of a 401k plan. Contributions are made before taxes, which allows the funds to grow tax-free over time.

This is particularly appealing in a high-income bracket, as it enables individuals to delay tax payments until retirement, when tax rates may be lower. According to the Internal Revenue Service, tax-deferred growth can lead to substantial savings, with compound interest adding up to tens of thousands of dollars over the course of several decades.While tax-deferred growth is a clear advantage, it’s essential to consider the potential estate implications of a 401k plan.

Generally, 401k plans are subject to federal estate taxes, which can be a major consideration for wealthy individuals. When determining estate plans, it’s crucial to understand the rules and regulations surrounding 401k plans, including how they are treated in the event of your passing.

Inheritance and Estate Taxes

When a 401k plan account holder passes away, the beneficiaries typically receive a lump sum or installment payments, depending on the plan provisions and individual circumstances. Beneficiaries may assume the tax liability on the 401k assets, but estate taxes may apply to the total value of the estate. The tax implications can be complex, with potential tax rates ranging from 18 to 40 percent.For high-net-worth individuals, estate taxes can be a significant concern when planning for 401k distributions.

A well-crafted estate plan should take into account the rules for 401k plan inheritance and potential estate taxes to ensure that the intended beneficiaries receive the maximum benefit from the 401k plan.

Tax Obligations and Required Minimum Distributions (RMDs)

After age 72, 401k plan participants must begin taking Required Minimum Distributions (RMDs), which are taxed as ordinary income. RMDs are calculated based on the account balance and life expectancy, and can significantly impact an individual’s tax liability. Understanding the RMD rules and how they apply to 401k plan distributions is essential for effective tax planning.When managing net worth, it’s critical to consider the tax implications of 401k plan distributions.

By planning ahead and understanding the tax obligations and RMD rules, individuals can minimize tax liabilities and make the most of their 401k plan savings.

“With proper planning, 401k plan distributions can be optimized to minimize tax liabilities and maximize benefits for the intended beneficiaries.”

- Consult with a tax advisor or estate planning expert to understand the rules and regulations surrounding 401k plans and tax implications.

- Consider strategies for minimizing tax liabilities, such as charitable donations or tax-efficient investment management.

- Develop a comprehensive estate plan that takes into account 401k plan provisions and potential estate taxes.

Managing 401k to Meet Net Worth Goals

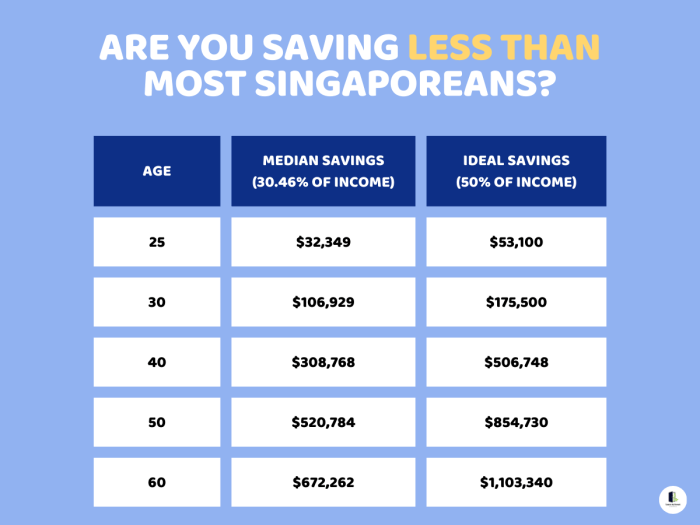

![Five habits of 401(k) millionaires [INFOGRAPHIC] | Lightship Wealth ... Does a 401k count towards net worth](https://i1.wp.com/moneyguy.com/wp-content/uploads/2024/03/401k-balance-30s.jpg?w=700)

Setting and achieving net worth goals with a 401k plan can be a daunting task, but with a step-by-step guide, you can navigate the process with ease. The key is to create a tailored plan that accounts for your individual financial situation, income fluctuations, and investment market changes.To begin, it’s essential to understand that net worth is the total value of your assets minus your liabilities.

In the context of a 401k, it’s the balance in your account minus any loans or withdrawals taken.Now, let’s dive into the step-by-step guide to managing your 401k and meeting your net worth goals.

Step 1: Assess Your Finances and Goals

Start by evaluating your income, expenses, assets, and liabilities. Identify your short-term and long-term financial objectives, and determine how your 401k contributions will help you achieve them.For instance, if you aim to retire comfortably in 20 years, you’ll need to consider factors such as your current age, desired retirement age, expected retirement income, and estimated expenses in retirement.

Step 2: Calculate Your 401k Contribution Rate

Determine how much you can afford to contribute to your 401k each month. Consider your income, expenses, debts, and other financial obligations. Aim to contribute at least 10% to 15% of your income towards your 401k.For example, if you earn $50,000 per year or $4,167 per month, you may aim to contribute $417-$625 per month towards your 401k.

Step 3: Choose Your Investment Options

Carefully review your 401k plan’s investment options and select a mix that aligns with your risk tolerance and financial goals. You may consider a diversified portfolio with a combination of stocks, bonds, and other investment vehicles.For instance, if you’re conservative, you may allocate 60% to 70% of your portfolio to fixed-income investments like bonds and 30% to 40% to equities.

Step 4: Monitor and Adjust Your Progress

Regularly review your 401k account and adjust your contributions, investment mix, or both as needed. Consider factors such as changes in your income, expenses, or financial goals, as well as shifts in the investment market.For example, if you experience a significant increase in income, you may be able to contribute more towards your 401k each month. Alternatively, if the investment market becomes volatile, you may need to reassess your investment mix and adjust your contributions accordingly.

Adapting to Changes in Income, Employment, or Investment Market

Life is full of unexpected twists and turns, and your financial situation is no exception. When faced with changes in income, employment, or investment market, it’s essential to adapt your 401k contributions and investment strategy accordingly.For instance, if you experience a reduction in income, you may need to adjust your contribution rate downwards. Conversely, if you receive an employment offer with a significantly higher salary, you may be able to increase your contributions.

Strategies for Adapting to Changes

When adapting to changes in your income, employment, or investment market, consider the following strategies:

- Reduce your contribution rate to maintain a balanced budget

- Adjust your investment mix to mitigate losses or lock in gains

- Take advantage of catch-up contributions, if eligible, to maximize your 401k savings

- Explore alternative investment options, such as annuities or real estate investments, to diversify your portfolio

By following these steps and adapting to changes in your income, employment, or investment market, you can effectively manage your 401k and meet your net worth goals.

Questions Often Asked

Does a 401k count towards net worth if I’m still contributing to it?

Yes, a 401k plan is typically included in your overall net worth calculation, even if you’re still actively contributing to it.

Can I use my 401k to pay off debt and still count it towards net worth?

No, using your 401k to pay off debt may impact your ability to count it towards your net worth, as these withdrawals can trigger taxes and penalties.

How do employer matching contributions affect my net worth if I don’t fully vest?

Even if you don’t fully vest in employer matching contributions, these benefits can still impact your net worth, potentially making them more valuable than other forms of savings.

Can I roll over my 401k into an IRA or other retirement account and still count it towards net worth?

Yes, rolling over your 401k into an IRA or other retirement account can help preserve its value and keep it included in your overall net worth calculation.