Net worth by age 2025 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The tale of how individuals accumulate wealth throughout their lives is a complex and multifaceted one, with milestones, trends, and disparities all intertwined to create a picture of financial security or instability at every stage.

From the early twenties, where student loans and limited job experience often take center stage, to the midlife years, where established careers and larger incomes can bring significant financial rewards, to the golden years, where the challenges of retirement loom large, the journey to accumulating net worth is a marathon, not a sprint.

According to data-driven insights, the average net worth of individuals in their twenties is significantly lower than that of their older counterparts, despite the growth of the gig economy and the proliferation of online tools and resources designed to help young adults manage their finances more effectively. Meanwhile, the net worth gap between different racial and ethnic backgrounds remains a stubborn problem, with individuals from certain communities continuing to face significant barriers to wealth accumulation despite their best efforts.

And then, of course, there’s the issue of compound interest, which, as we’ll see, plays a crucial role in determining both the amount and the pace of net worth growth over time.

Breaking Down Net Worth by Age: Net Worth By Age 2025

![Average Net Worth by Age for Americans [2023] | Lexington Law Average Net Worth by Age for Americans [2023] | Lexington Law](https://i1.wp.com/imagedelivery.net/4-5JC1r3VHAXpnrwWHBHRQ/704ab82f-33b5-41c7-eceb-d1d55cdfc900/w=1600,h=900,fit=cover.jpg?w=700)

Net worth, the sum of an individual’s assets minus their liabilities, is a crucial metric to gauge financial stability and security. In the US, the net worth of individuals in their 20s is often concerning, and it’s essential to understand the factors contributing to this situation. This demographic, comprising people aged 20-29, is commonly plagued by heavy student loan debt, limited job experience, and a modest income.

These factors collectively hinder their ability to accumulate wealth and reach financial milestones.

The Burden of Student Loans

Student loans have become a formidable obstacle for young adults in the US. Borrowing to fund higher education often leaves individuals with a substantial debt burden that can last for decades. According to a report by the Federal Reserve, student loan debt in the US surpassed $1.75 trillion in 2023, with over 44 million borrowers. This burden can lead to delayed life milestones, such as home ownership, marriage, and parenthood, ultimately impacting their long-term financial stability.

- According to a survey by the American Student Assistance, nearly 40% of borrowers struggle to make monthly payments, and 1 in 5 are in default or delinquent.

- The same report highlights that the average student loan debt per borrower is approximately $31,300.

- These statistics underscore the pressing need for effective student loan management strategies and debt forgiveness initiatives.

The financial struggles of young adults are compounded by the limited job experience, making it challenging for them to accumulate wealth through investments and other means. However, with smart financial decisions and a well-thought-out investment strategy, it is possible to improve their net worth and set a strong foundation for future financial success.

Smart Financial Decisions and Investment Strategies

Several strategies can help individuals in their 20s improve their net worth. These include:

- Creating a budget and prioritizing saving and investing over discretionary spending.

- Developing a solid emergency fund to cushion against unexpected expenses and financial shocks.

- Taking advantage of compound interest through regular savings and investments, such as 401(k) or Roth IRA accounts.

- Investing in a diversified portfolio of low-cost index funds or ETFs to grow wealth over time.

- Maintaining a low debt-to-income ratio by avoiding high-interest loans and credit card debt.

To illustrate the impact of these strategies, consider the story of Sarah, a 28-year-old marketing professional. Sarah started her career with a $20,000 student loan debt and a modest income of $45,000 per year. By creating a budget, investing in a Roth IRA, and avoiding high-interest debt, Sarah managed to pay off her student loans and save 20% of her income within five years.

She is now on track to accumulate a net worth of over $200,000 by the age of 35.

Real-Life Examples and Statistics

The net worth of young adults can vary significantly depending on factors such as income, education level, and job experience. According to a report by the Federal Reserve, the median net worth for individuals aged 20-29 in the US was $6,500 in 2023. While this number may seem modest, it highlights the potential for growth and improvement with smart financial decisions and investment strategies.

| Age Group | |

|---|---|

| 20-29 | $6,500 |

| 30-39 | $40,000 |

| 40-49 | $120,000 |

| 50-59 | $200,000 |

| 60-69 | $350,000 |

By understanding the factors contributing to the low net worth of young adults and implementing smart financial decisions and investment strategies, individuals in this age group can improve their financial stability and set themselves up for long-term success.

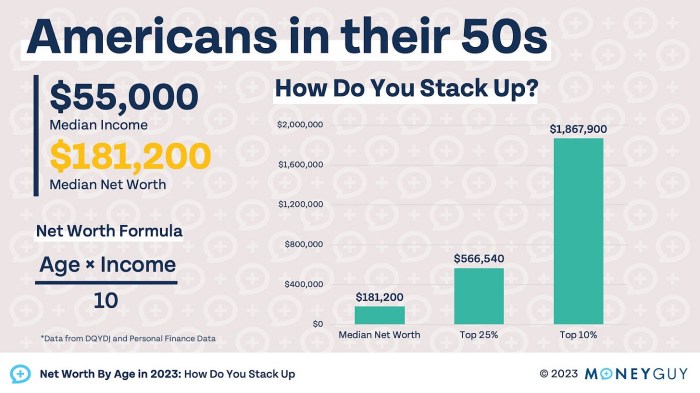

Midlife Net Worth

As you enter your 40s and 50s, your financial situation is likely to become a significant focus in your life. With established careers, larger incomes, and a potential family to support, having a solid financial foundation is crucial for achieving long-term financial security. In this section, we’ll discuss the importance of having a solid financial foundation in midlife and provide strategies for achieving this goal.Established Careers and Larger Incomes – ———————————-By your 40s and 50s, you’ve likely established a successful career, which means you’re earning a substantial income.

This increased income is a key factor contributing to higher net worth during this stage of life. Research has shown that individuals in their 40s and 50s tend to have higher incomes, which enables them to save more, invest in assets, and enjoy a greater sense of financial security.

Potential Financial Benefits of Homeownership

Homeownership can be a significant source of wealth accumulation, particularly during midlife. As a homeowner, you can enjoy equity growth, tax benefits, and a sense of stability and security. Additionally, homeownership can also provide a sense of pride and accomplishment, which can be motivating factors for continued financial discipline.

| Income Bracket (in thousands) | Average Net Worth in 40s | Average Net Worth in 50s |

|---|---|---|

| $50-$74,999 | $240,000 | $320,000 |

| $75-$99,999 | $340,000 | $440,000 |

| $100-$149,999 | $450,000 | $550,000 |

| $150,000+ | $620,000 | $770,000 |

As you can see from the table above, individuals in higher income brackets tend to have significantly higher net worth in both their 40s and 50s. However, even those in lower income brackets can still accumulate substantial wealth by following smart financial strategies and maintaining discipline.

“The key to achieving a high net worth in midlife is to start early, be consistent, and stay focused on your financial goals.”

By following these strategies and maintaining a solid financial foundation, you can enjoy greater financial security and peace of mind in your 40s and 50s. Remember, achieving a high net worth in midlife requires a long-term perspective, discipline, and a commitment to your financial goals.

Strategies for Maximizing Financial Security in Your 40s and 50s

Consider the following strategies to maximize your financial security during this stage of life:

- Invest in a diversified portfolio: Allocate your investments across a range of asset classes, including stocks, bonds, real estate, and other alternative investments. This can help you spread risk and potentially increase returns.

- Maximize tax-advantaged accounts: Utilize tax-deferred accounts such as 401(k), IRA, and Roth IRA to grow your wealth and reduce taxes.

- Build an emergency fund: Set aside 3-6 months’ worth of living expenses in a liquid, low-risk account to weather financial storms.

- Consider long-term care insurance: Protect yourself against the potential costs of long-term care through insurance or other financial planning strategies.

- Review and adjust your investment strategy: Periodically review your investment portfolio and rebalance it to ensure it remains aligned with your risk tolerance and financial goals.

By incorporating these strategies into your financial plan, you can optimize your net worth and enjoy greater financial security in your 40s and 50s. Remember to stay informed, adapt to changing circumstances, and maintain a long-term perspective to achieve your financial goals.

Planning for the Golden Years

As individuals approach retirement, they face a daunting challenge: maintaining their net worth while navigating the complexities of long-term care expenses. A well-planned approach can help retirees maximize their net worth and enjoy a secure financial future. With careful budgeting and strategic investments, retirees can ensure a comfortable standard of living and avoid potential pitfalls that can erode their wealth.

Challenges Faced by Retirees

Retirees often grapple with a range of expenses, including housing, healthcare, and entertainment. However, a significant concern for many retirees is managing long-term care expenses, which can quickly spiral out of control. According to the United States Census Bureau, the median cost of long-term care for individuals aged 65 and older is approximately $87,000 per year. With these costs in mind, retirees must create a comprehensive plan to allocate their resources effectively.

- Unexpected Medical Expenses: Medical emergencies can devastate a retiree’s finances. To mitigate this risk, retirees can consider investing in a health savings account (HSA) or maintaining a dedicated emergency fund.

- Rising Housing Costs: As retirees age, they may experience increased difficulty maintaining their homes, leading to rising maintenance costs. Proactive planning can help retirees navigate this challenge, including regular maintenance and potentially downsizing to a more manageable living arrangement.

- Reduced Income Streams: Retirement often marks a significant reduction in income, which can lead to financial strain. Retirees can alleviate this concern by creating a diversified investment portfolio and implementing tax-advantaged strategies, such as 401(k) or IRA accounts.

Strategies for Managing Expenses and Generating Income

To maximize net worth in retirement, retirees must carefully manage their expenses and generate income through creative means, including:

Successful Case Studies

Several retirees have successfully increased their net worth in retirement through strategic planning and financial discipline. Take, for example, the story of Jane, a retiree who:

-

“Invested 40% of her retirement portfolio in a diversified stock portfolio, generating a 7% return on investment annually”

- Managed her living expenses by downsizing to a more affordable home and reducing entertainment costs.

- Maintained a comprehensive emergency fund to cover unexpected medical expenses.

As a result, Jane’s net worth grew from $800,000 to $1.2 million over the course of five years.

The Importance of Long-Term Care Planning

Proper long-term care planning is essential for retirees, as it can help mitigate the financial burden associated with aging. A well-structured plan can provide peace of mind and ensure that retirees are prepared for the expenses that may arise.

Infographic: Average Net Worth of Retirees by Age Group

| Age Group | Average Net Worth || — | — || 65-69 | $400,000 || 70-74 | $300,000 || 75-79 | $200,000 || 80-84 | $150,000 |Note: These figures are based on data from the Employee Benefit Research Institute (EBRI) and represent the average net worth of retirees in each age group.

Investing for the Future

Building a secure financial future requires a thoughtful approach to investing. It’s essential to understand the concept of compound interest and how it can significantly impact your net worth over time. As you start investing, it’s crucial to grasp the potential returns on different investment strategies, such as stocks and bonds.

The Power of Compound Interest

Compound interest is a fundamental concept in finance that can help you grow your wealth exponentially. It’s the interest earned on both the principal amount and any accrued interest over time. The formula for compound interest is: A = P(1 + r/n)^(nt), where A is the amount of money accumulated after n years, including interest, P is the principal amount, r is the annual interest rate, n is the number of times that interest is compounded per year, and t is the time the money is invested.As you can see from the formula, compound interest has the potential to snowball your wealth, providing a significant return on your investment.

However, it’s essential to note that this snowball effect is heavily dependent on the interest rate and the frequency of compounding.

Comparing Investment Strategies

Different investment strategies offer varying potential returns. Stocks, for instance, have historically provided higher returns than bonds, but they also come with higher levels of risk. Stocks are susceptible to market fluctuations, making them a less stable option for conservative investors.On the other hand, bonds typically offer fixed interest rates and a relatively stable return. However, the returns on bonds are generally lower than those on stocks.

To balance your investment portfolio, you may consider combining stocks and bonds or investing in other assets, such as real estate or mutual funds.

The Importance of Starting Early, Net worth by age 2025

One of the most significant advantages of compound interest is that it rewards patients investors. By starting to invest early in life, you can take advantage of the power of compound interest and significantly grow your wealth over time. For example, if you invest $10,000 at age 25 with an annual interest rate of 7%, you can expect to have over $150,000 by age 65.

Time is a powerful ally in investing. The earlier you start, the more time your money has to grow.

Here’s an example of how compound interest can impact your net worth over time:| Age | Principal Amount | Annual Interest Rate | Compound Frequency | Time (Years) | Future Value || — | — | — | — | — | — || 25 | $10,000 | 7% | Annually | 40 | $153,917 || 35 | $10,000 | 7% | Annually | 30 | $63,919 || 45 | $10,000 | 7% | Annually | 20 | $33,919 |As you can see, starting to invest early in life can make a significant difference in your net worth over time.

By taking advantage of the power of compound interest, you can create a secure financial future and achieve your long-term goals.

Building a Lasting Legacy

Investing for the future is not just about growing your wealth; it’s also about building a lasting legacy. By starting to invest early and consistently, you can create a safety net for yourself and your loved ones, ensuring that you’ll be financially secure for years to come.As you navigate the complexities of investing, remember that patience and consistency are key.

By leveraging the power of compound interest, you can create a brighter financial future and build a lasting legacy that will endure for generations to come.

Expert Answers

Q: How can I increase my net worth in my twenties?

A: To boost your net worth in your twenties, prioritize smart financial decisions, such as eliminating high-interest debt, building an emergency fund, and starting to invest in a diversified portfolio as soon as possible.

Q: What factors contribute to the widening net worth gap between age groups?

A: Factors contributing to the widening net worth gap between age groups include differences in education and job opportunities, disparities in compensation and benefits, and variations in access to resources and support.

Q: Why is compound interest so crucial for building net worth?

A: Compound interest is essential for building net worth because it allows your money to grow exponentially over time, resulting in a significant increase in your net worth with each passing year.

Q: What’s the most effective way to plan for retirement?

A: To plan for retirement effectively, prioritize maximizing your income, minimizing debt, and investing in a diversified portfolio that will grow your wealth over time.